Life Insurance in and around Wichita

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

No one likes to focus on death. But taking the time now to secure a life insurance policy with State Farm is a way to show care to the ones you hold dear if you pass.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less complicated for your partner and give time to recover. It can also help cover matters like college tuition, future savings and medical expenses.

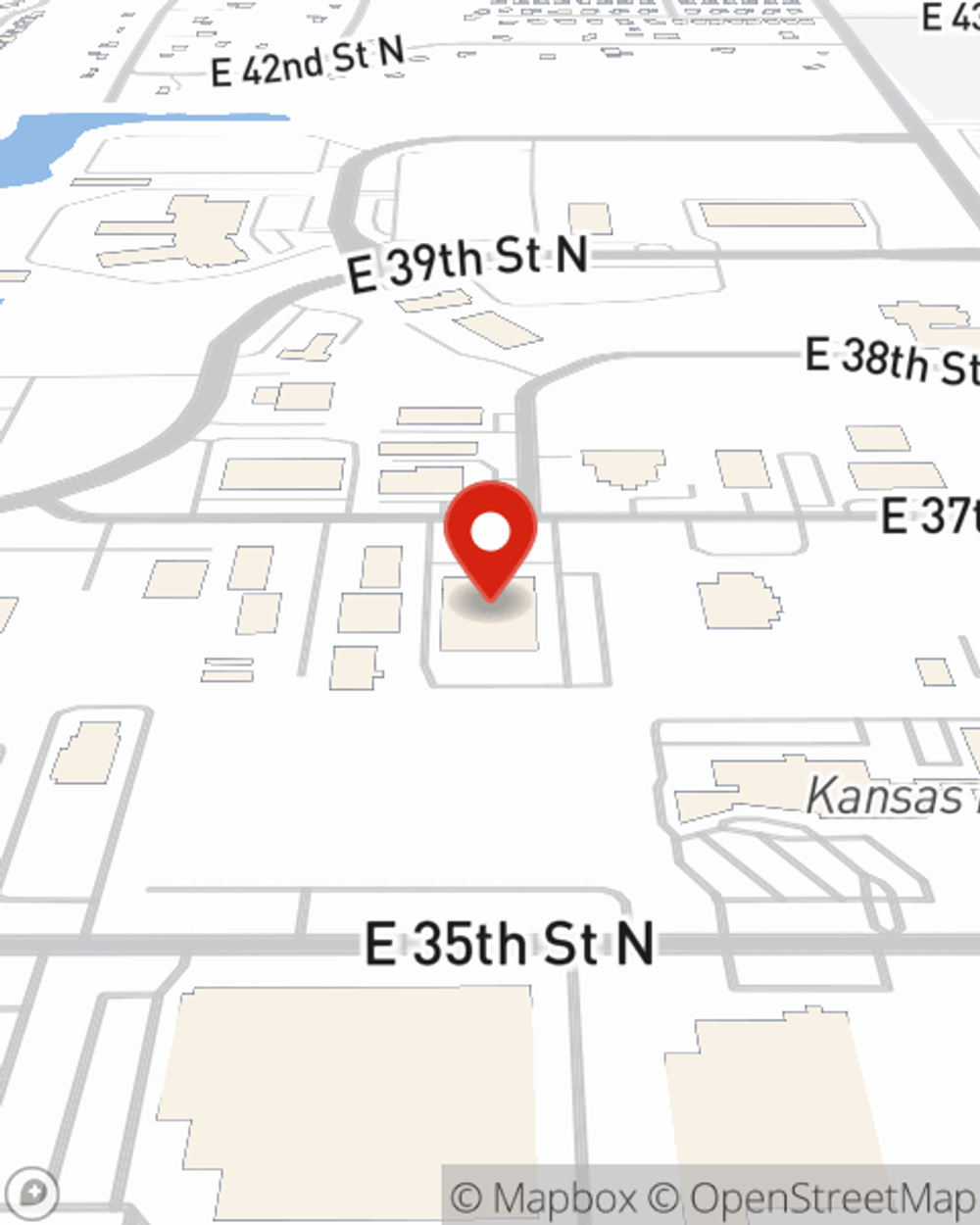

If you're looking for dependable coverage and caring service, you're in the right place. Reach out to State Farm agent Nate Thom today to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Nate at (316) 219-7808 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.